Ai16z – Assessing impact of $6.37M whale withdrawal on coin’s price

- A whale withdrew 5.64 million ai16z tokens, valued at $6.37 million, from Gate.io.

- On-chain data revealed an increase in active ai16z wallet addresses by 12% over the past week, reflecting growing user engagement.

💰 The cryptocurrency market recently witnessed a significant transaction involving ai16z, drawing attention to the token’s growing prominence.

A whale entity withdrew 5.64 million ai16z [AI16Z] tokens, valued at $6.37 million, from Gate.io, increasing their total holdings to 15.95 million ai16z, worth $17.86 million.

This large-scale withdrawal underscores potential strategic moves, possibly reflecting the investor’s confidence in the token’s long-term value or intentions to utilize the assets in alternative investments.

As market participants analyze these developments, attention shifts to ai16z’s current market performance and technical indicators for further insights.

📈 Current market performance

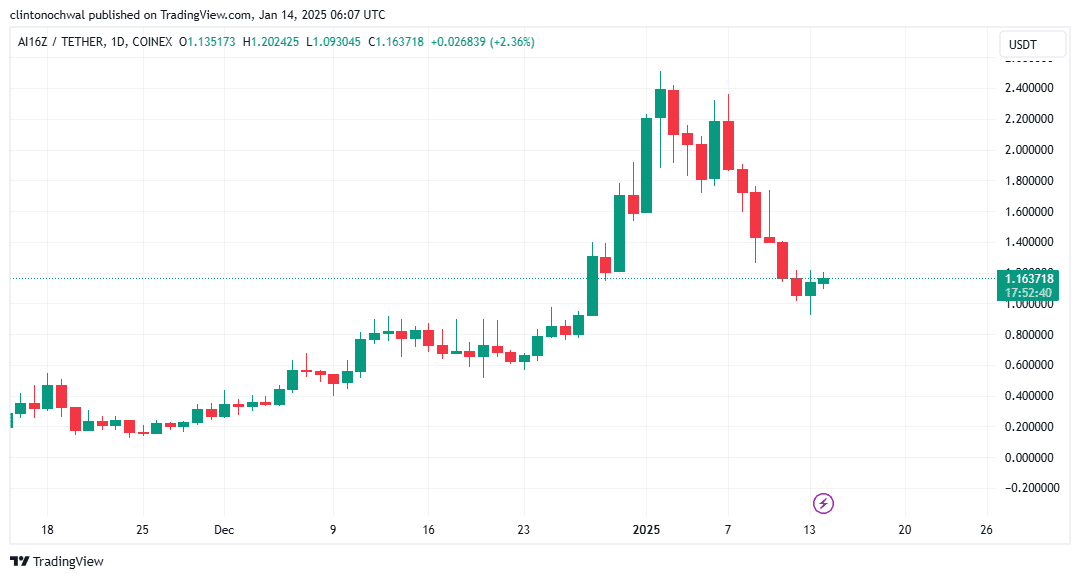

ai16z has experienced a modest increase in trading volume over the past 24 hours, signaling heightened market activity. The token’s price currently hovers around $1.16, maintaining a narrow consolidation range.

Also, broader market conditions, including Bitcoin’s price stability and improving altcoin sentiment, have likely contributed to ai16z’s performance.

However, it’s important to note that the AI-focused cryptocurrency sector, including ai16z, has been among the worst-hit in recent weeks, with several tokens experiencing sharp declines.

Despite this, the recent whale activity could introduce volatility, as large transactions often influence market trends.

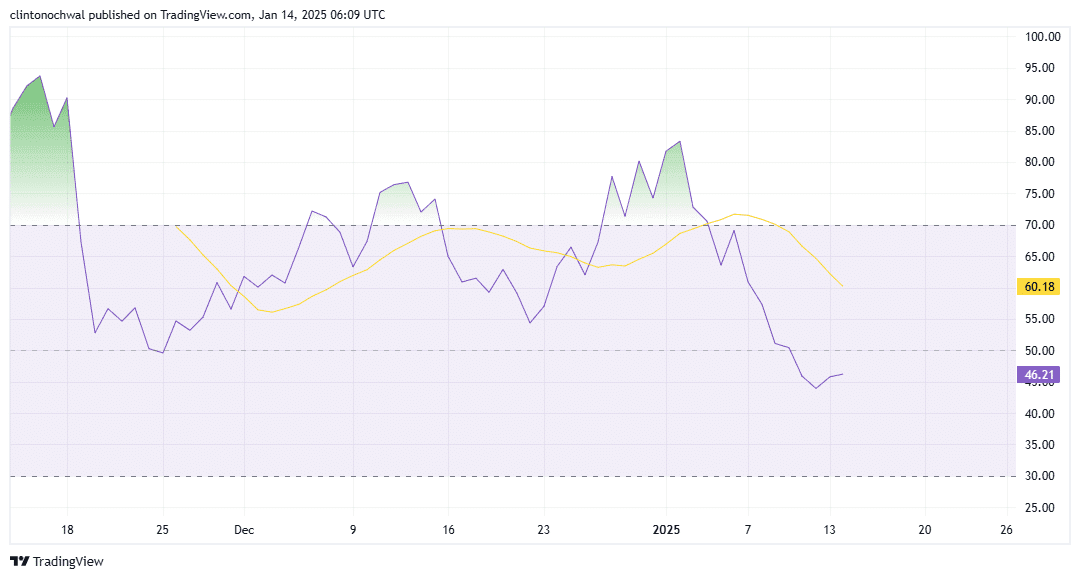

🌟 ai16z price analysis suggests…

ai16z’s price has been trading within a critical range, testing resistance at $1.18 and support at $1.05.

Recent whale accumulation suggests potential upward pressure, with a breakout above resistance possibly signaling a bullish trend.

However, technical indicators, including the RSI, currently show neutral momentum, indicating uncertainty in the market.

If the token breaks below its support level, it risks entering a bearish phase, potentially targeting $0.95.

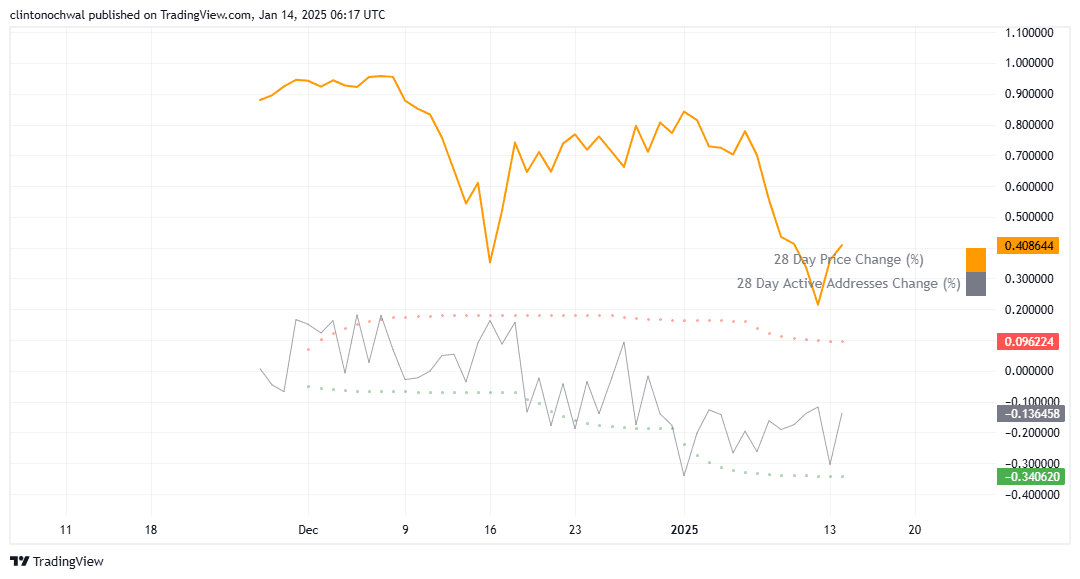

🌟 Active addresses analysis

On-chain data reveals an increase in active ai16z wallet addresses by 12% over the past week, reflecting growing user engagement.

This rise in activity often correlates with increased speculative interest, as traders position themselves in anticipation of significant price movements.

If active address growth persists, it could support bullish sentiment and improved liquidity. Conversely, a decline in activity might indicate reduced interest, potentially leading to stagnation or price declines.

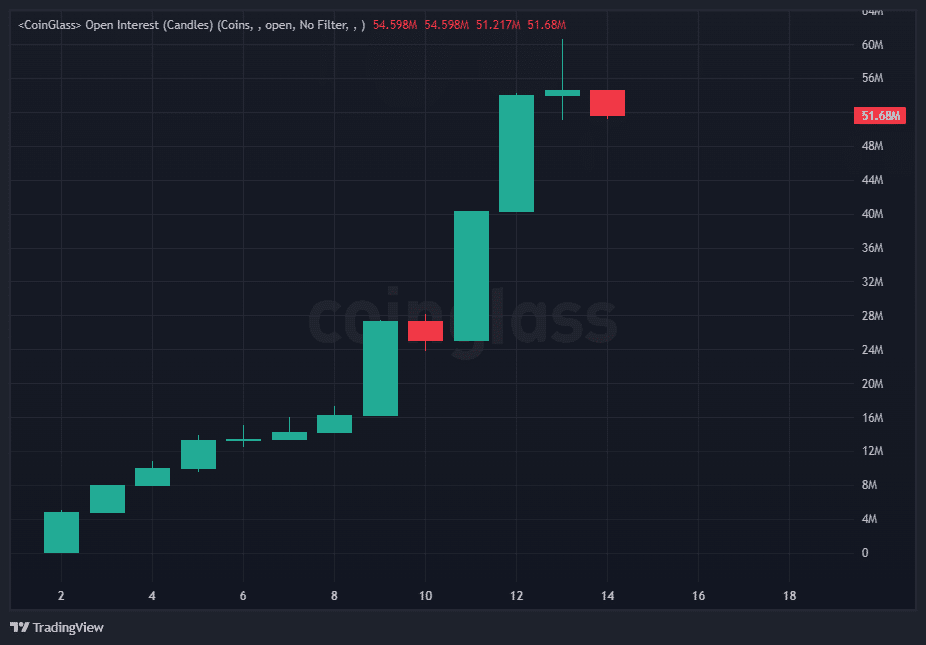

🌟 Open Interest analysis of ai16z

Open Interest (OI) in ai16z futures contracts has surged by 20% in recent days, indicating growing speculative activity. Notably, long positions dominate the market, reflecting optimism among traders.

If ai16z sustains its current price levels or breaks resistance, OI could increase further, fueling a potential rally.

Conversely, failure to maintain support may result in liquidations, amplifying downward pressure.

Neutral funding rates currently suggest balanced sentiment, but traders should watch for shifts that may indicate changes in market positioning.

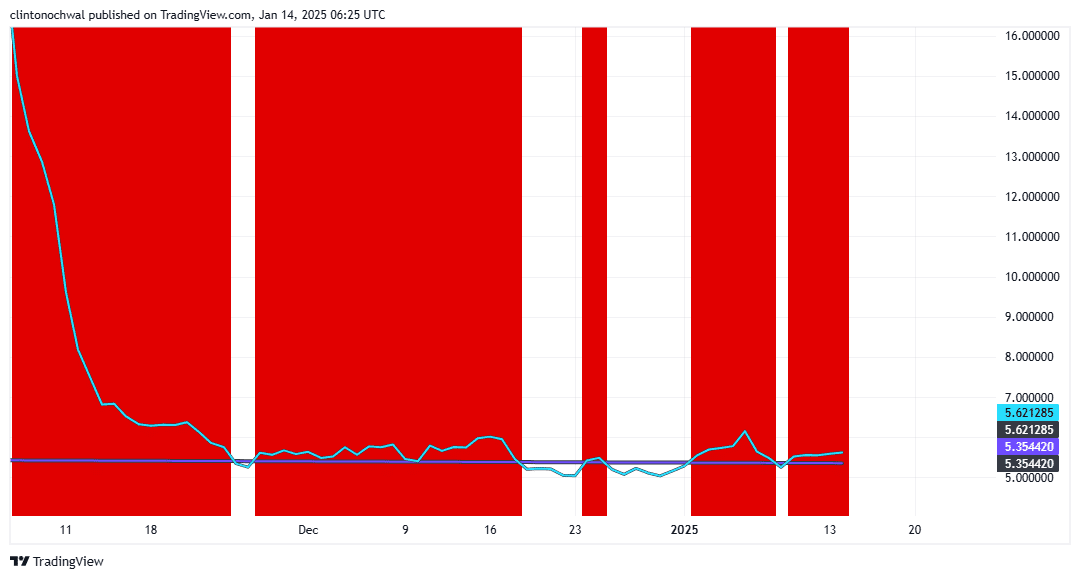

🌟 Reduced sell pressure from investors

If the short-term MVRV ratio turns positive, it could signal renewed buying interest, potentially driving prices higher. However, a sharp market correction could deepen losses for short-term traders, leading to broader uncertainty.

This is not investment advice.

Source

#COINMAP

—————

Related posts

Latest

Subscribe

Subscribe with your email to receive information and promotions from 8xTrading