Bitcoin ignores historic dollar breakdown: How long can this calm last?

Summary:

Net outflows and bearish derivatives may signal upcoming volatility and Bitcoin’s market shift. Whale inactivity and weakening stock-to-flow narrative limit bullish conviction despite macro support.

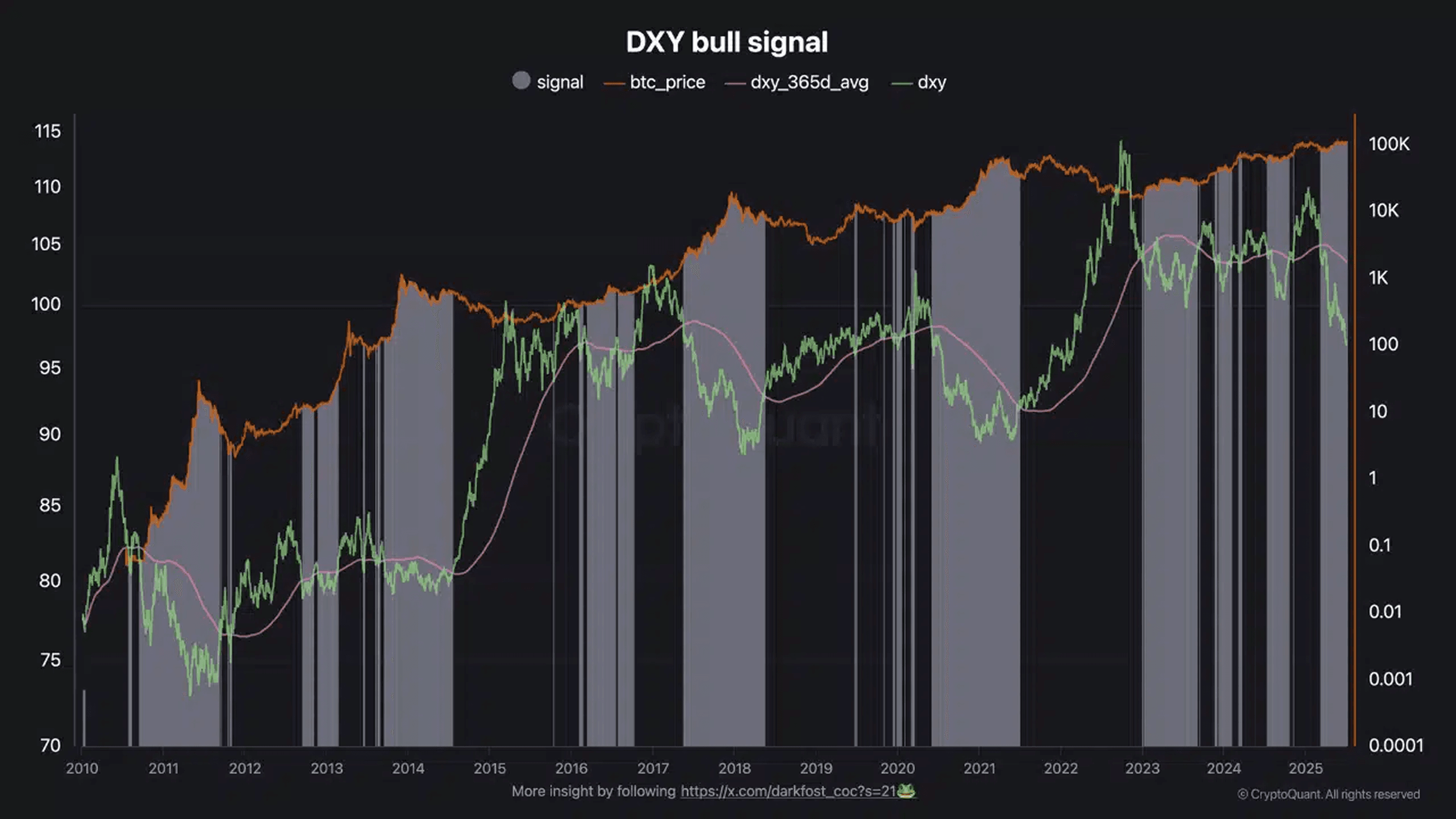

The U.S. Dollar Index [DXY] has dropped 6.5 points below its 200-day moving average, the largest deviation in 21 years, yet Bitcoin [BTC] has failed to respond.

Historically, such extreme dollar weakness has preceded a capital rotation into risk assets like Bitcoin, as investors flee depreciating fiat.

However, the king coin has remained range-bound, suggesting hesitation in market sentiment despite the macro setup favoring a breakout.

The disconnection between traditional risk indicators and crypto price action raises questions about what might be delaying a response, especially as other on-chain and derivative metrics begin to shift.

Is there a silent accumulation?

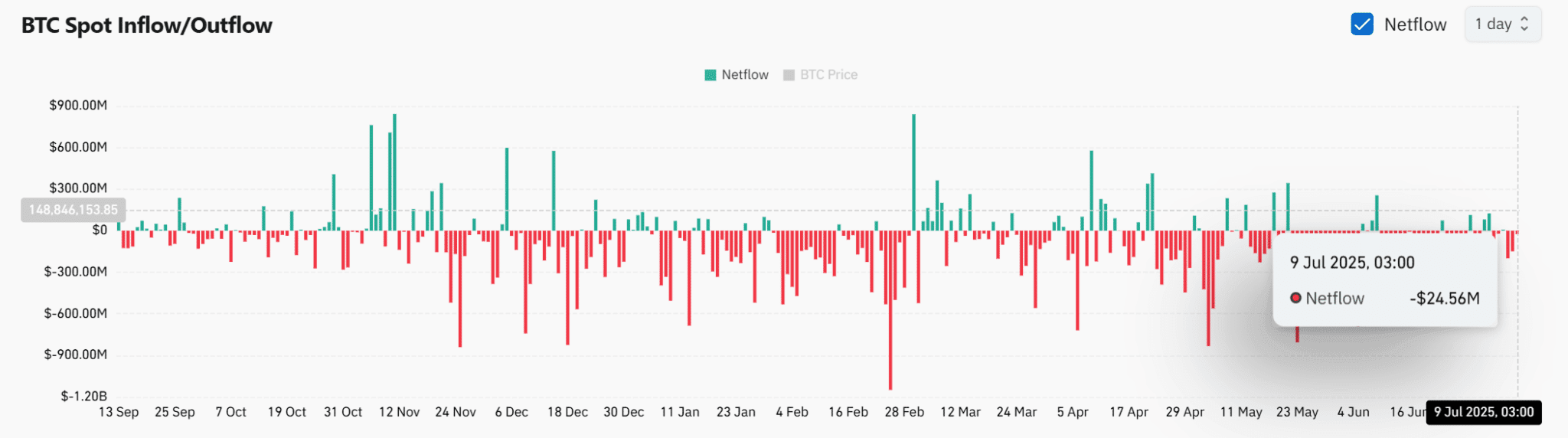

Bitcoin recorded $24.56 million in net outflows, continuing a trend of declining spot reserves across centralized exchanges.

Sustained outflows typically indicate investor preference to hold coins off-exchange, reducing immediate sell pressure.

This behavior often aligns with accumulation phases, especially when it coincides with macroeconomic instability like dollar weakness.

While the current scale of outflows remains moderate compared to past rallies, the consistency suggests that investors are positioning themselves cautiously, possibly anticipating a volatility event.

Đám đông bi quan ngày càng lớn tiếng

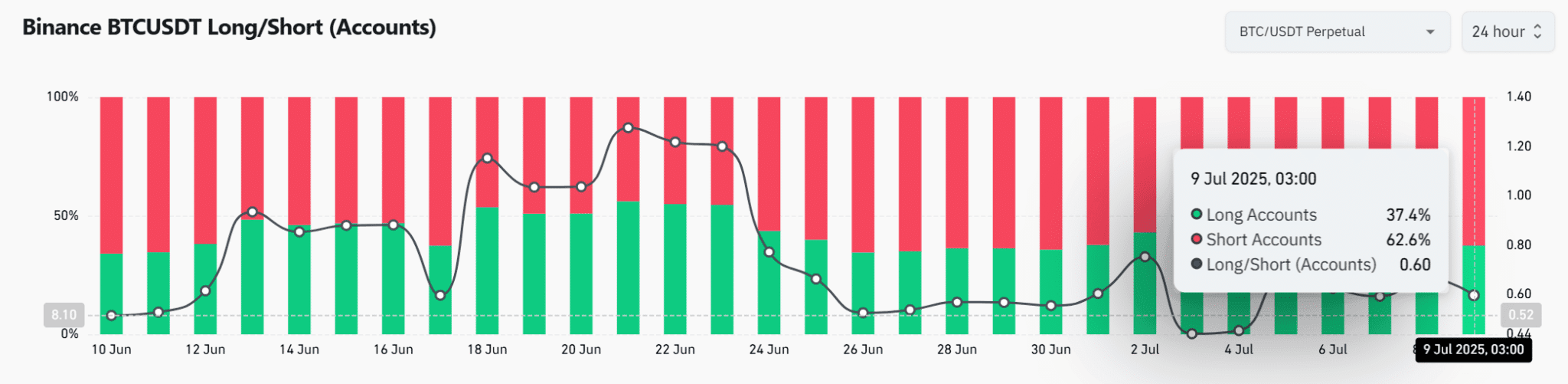

Trên Binance, 62,6% nhà giao dịch BTCUSDT vĩnh viễn nắm giữ vị thế bán khống tại thời điểm báo chí đưa tin, đẩy tỷ lệ Long/Short xuống còn 0,60. Điều này đánh dấu xu hướng giảm mạnh, có thể đóng vai trò là nhiên liệu cho sự đảo chiều đột ngột.

Theo truyền thống, sự mất cân bằng như vậy đã gây ra tình trạng bán khống khi động lực thị trường thay đổi, buộc những người bán khống phải mua lại và đẩy nhanh tốc độ tăng giá.

Mặc dù giá cả vẫn ở mức thấp, nhưng tỷ lệ lệch phản ánh sự căng thẳng gia tăng.

Do đó, các nhà giao dịch nên cảnh giác với sự biến động đột ngột, vì bối cảnh phái sinh hiện tại có thể khuếch đại các động thái tăng giá mà không có nhiều cảnh báo.

Bearish crowd grows louder

On Binance, 62.6% of BTCUSDT perpetual traders held short positions at press time, pushing the Long/Short ratio down to 0.60. This marks a strong bearish bias, which could act as fuel for a sudden reversal.

Historically, such imbalances have triggered short squeezes when market momentum shifts, forcing shorts to cover and accelerating price jumps.

Although price action has remained subdued, the skewed ratio reflects mounting tension.

Therefore, traders should remain alert to sudden volatility, as the current derivative landscape could amplify upward moves with little warning.

Why are whales pulling back despite a weak dollar?

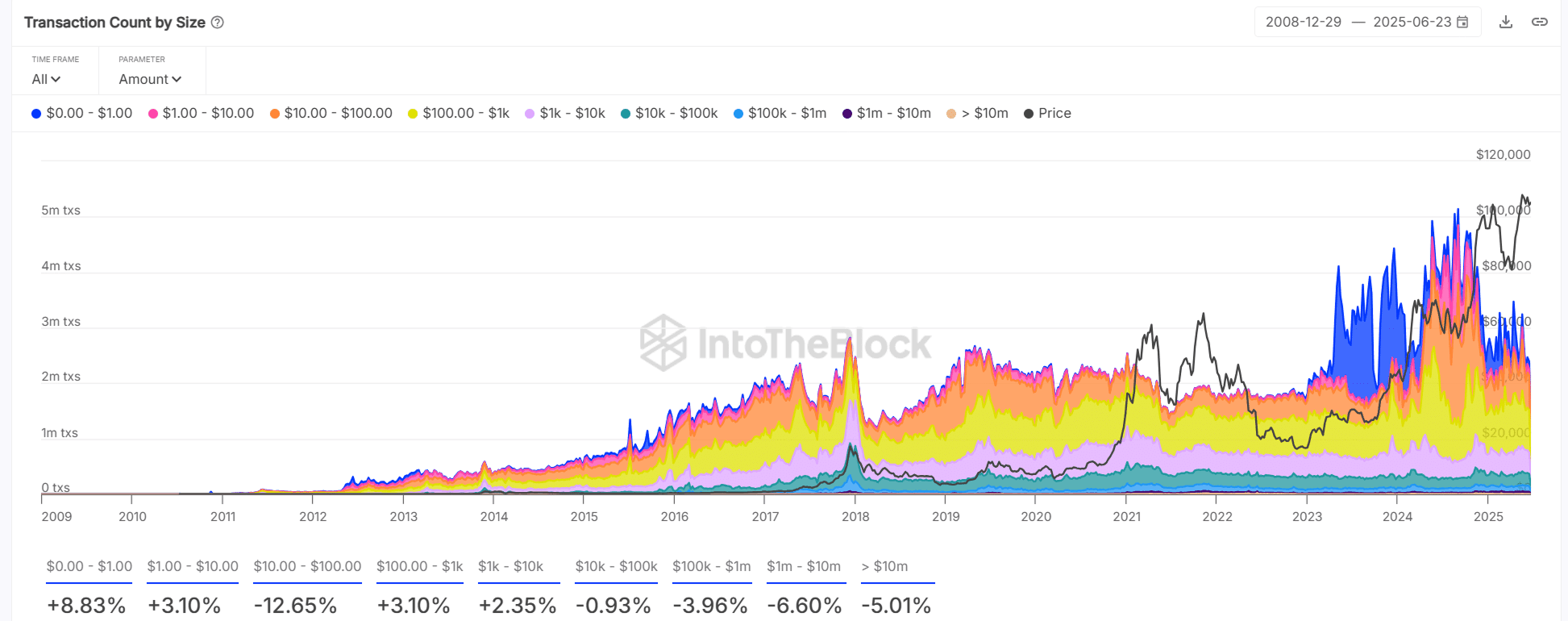

Despite favorable macro conditions, on-chain data reveals a significant drop in high-value Bitcoin transactions.

Transfers in the $1 million to $10 million range fell 6.6%, while those above $10 million declined by 5.01%.

This retreat suggests that large investors remain cautious, potentially due to lingering regulatory or macroeconomic uncertainties.

Additionally, the lack of whale activity limits momentum and raises doubts about whether smart money views this as a true accumulation zone.

Without their participation, any retail-driven rally may lack the staying power needed for sustained price appreciation.

Will BTC finally respond to macro pressure?

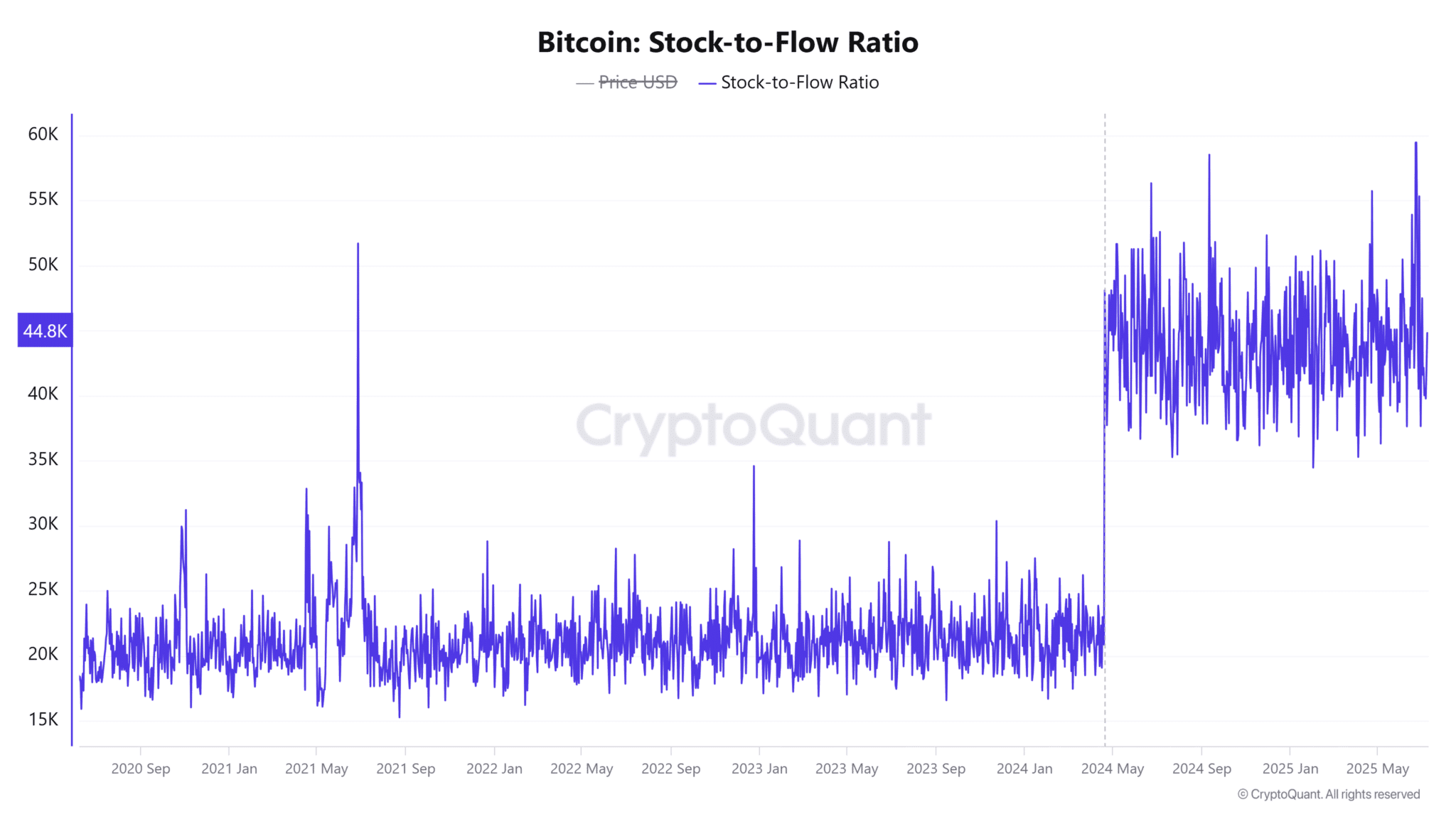

The dollar’s historic weakness typically supports bullish BTC setups, yet price action remains muted.

Exchange outflows and bearish derivatives positioning suggest a potential reversal, but falling whale activity and a weakening scarcity narrative cloud the outlook.

A breakout remains possible—but not guaranteed—unless new capital or momentum drives the market out of its current standoff.

This is not investment advice.

#COINMAP

—————

Related posts

Latest

Subscribe

Subscribe with your email to receive information and promotions from 8xTrading