ai16z sees a 13.15% price drop after short, swift rally – What happens next?

Summary:

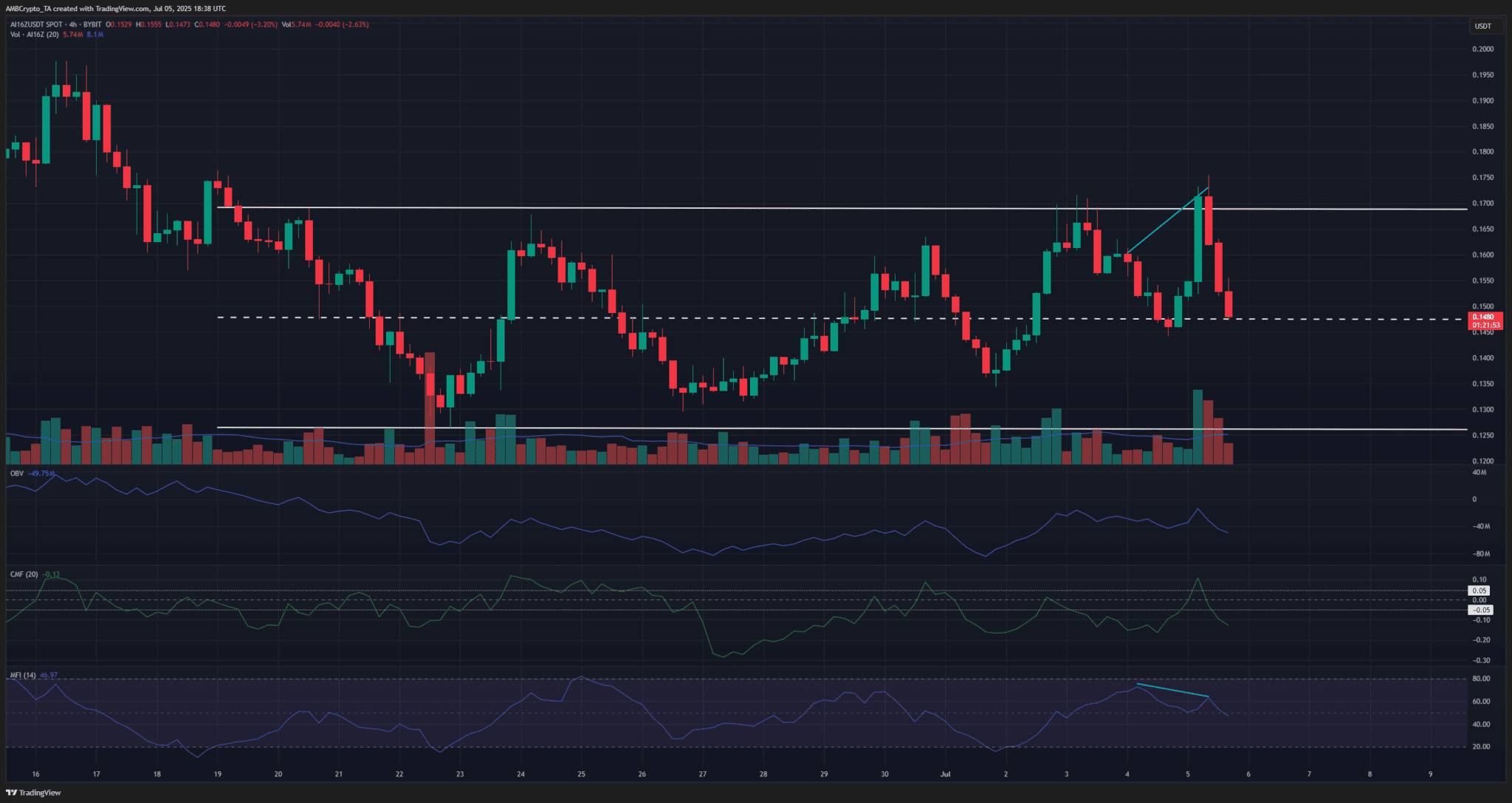

- ai16z saw strong short-term bullish sentiment during the rally to $0.175, which was quickly reversed.

- The CMF indicator showed which way traders should expect the price to swing next.

AI agent token ai16Z [AI16Z] saw strong short-term bullish sentiment. After the pullback to $0.134 on the 1st of July, the token has rebounded strongly.

It rallied 30% in under four days, reaching a local high of $0.175, before volatility kicked in again.

The AI agent token saw a remarkable uptick in Open Interest, with an 18.2% increase within the past 24 hours. Accounting for the swift pullback from $0.175, AI16Z was only up 2.05% within the past day.

The high OI and positive funding rate pointed toward intense short-term bullish sentiment.

This sentiment could have worked against the bulls, as the liquidity around the $0.175 resistance was swept before a bearish reversal.

AMBCrypto examined whether the altcoin’s bulls could make another breakout attempt soon.

Is AI16Z rallying or consolidating?

The AI agent token saw a remarkable uptick in Open Interest, with an 18.2% increase within the past 24 hours. Accounting for the swift pullback from $0.175, AI16Z was only up 2.05% within the past day.

The high OI and positive funding rate pointed toward intense short-term bullish sentiment.

This sentiment could have worked against the bulls, as the liquidity around the $0.175 resistance was swept before a bearish reversal.

AMBCrypto examined whether the altcoin’s bulls could make another breakout attempt soon.

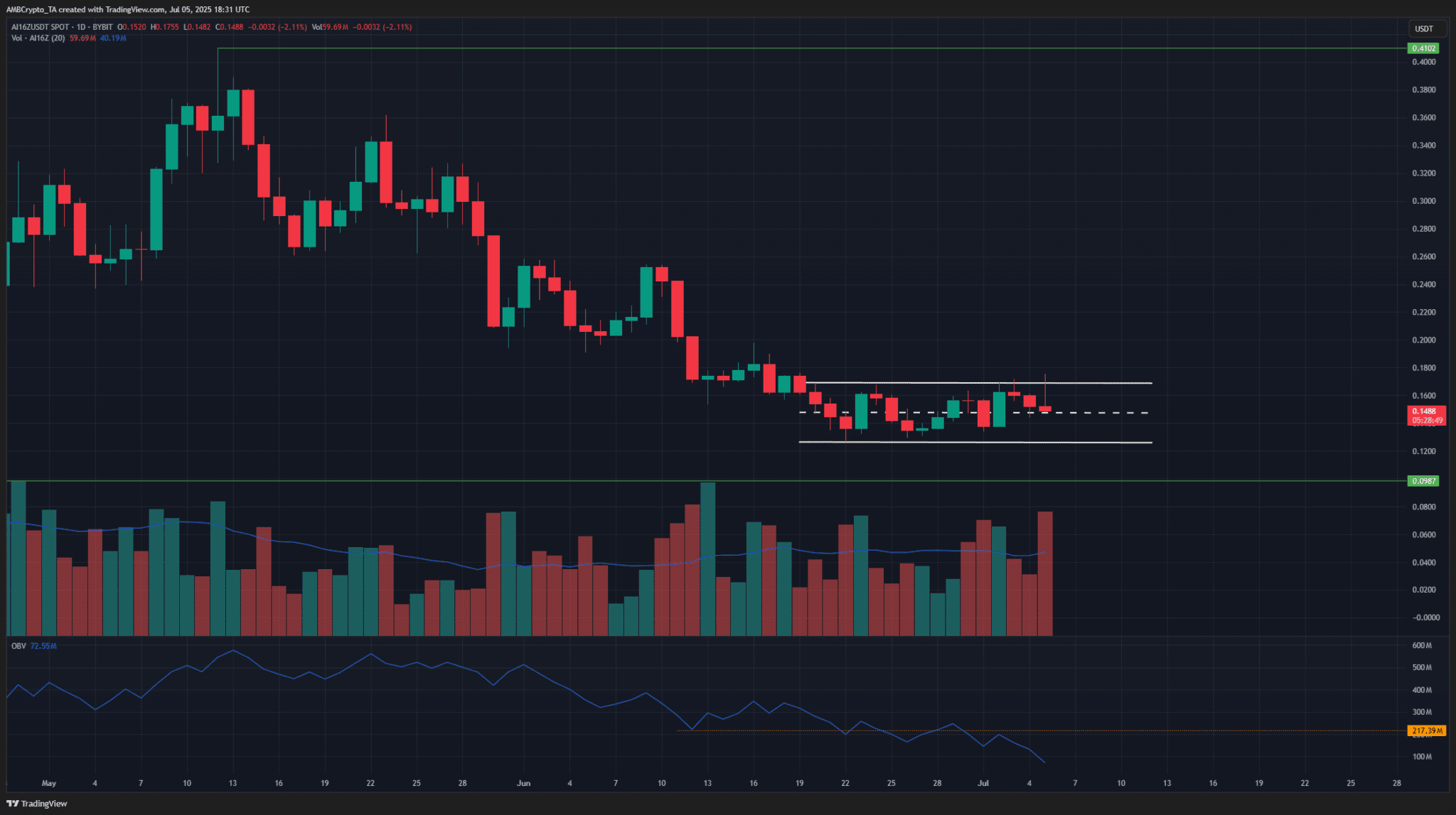

The 4-hour chart saw a bearish divergence between the MFI and the price, followed by a wicked rejection at the range highs. At the time of writing, the price was at the mid-range support.

Inability to defend this level would mean that swing traders can prepare for a drop toward $0.135, or as deep as $0.126.

While the OBV appeared to trend higher over the past week, the CMF has been below -0.05 for the majority of the past week.

The CMF was a more nuanced volume indicator because of how it weighs the volume based on where the price closes within the day’s trading range.

The +0.05 and -0.05 also filter out bad signals, making the CMF’s findings more reliable.

The CMF showed that sellers have had the upper hand, while the ai16z token traded within a range. Therefore, AI16Z was neither rallying nor consolidating.

The consistent selling pressure meant that distribution was underway, and investors should beware.

This is not investment advice.

#COINMAP

—————

Related posts

Latest

Subscribe

Subscribe with your email to receive information and promotions from 8xTrading