Cryptocurrencies:

Exchanges:

Market Cap:

24h Vol:

Dominance:

GAS:

Fear & Greed:

Bitcoin reaches an all-time high above $107K

Dec 22, 2024

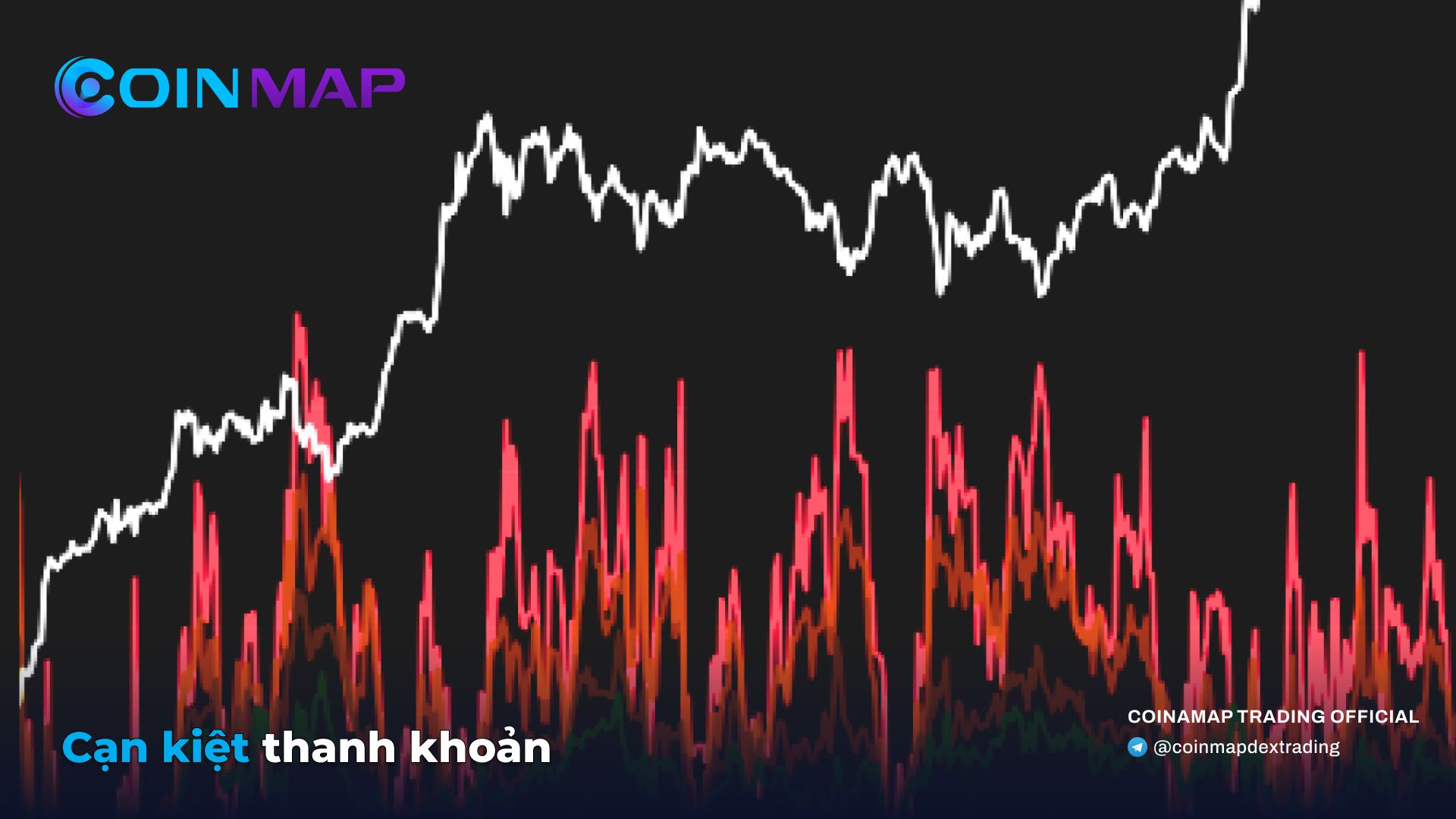

📊 Investor Cost Base Distribution (CBD) Analysis before this milestone:

Data from Glassnode's CBD tool reveals how investors are distributing and accumulating BTC at various price levels, reflecting strong confidence and demand that have driven this rally.

🔎 Detailed Supply Distribution:

$96K–$100K Range

There has been strong investor activity, showing significant demand and confidence as BTC is accumulated at these levels.

- $97K–$98K: The strongest accumulation cluster, with around 500K BTC held in this range.

- $99.3K: Provides the last key support level below $100K, with approximately 63K BTC concentrated in this region.

Above $100K Range

BTC supply thins out as the price surpasses $100K, though there remains steady accumulation demand:

- $101K–$102K: Investors have accumulated nearly 200K BTC, with around 60K BTC concentrated at $101.33K.

- $102.8K: Another notable level, with about 37K BTC, indicating continued demand at higher price levels.

📈 Chart Explanation:

- Black line: Bitcoin’s price gradually increases over time from $97K to new highs above $105K.

- Color in the chart: Represents the supply of BTC (accumulation clusters) at different price levels:

- Red/Deep colors: Areas with large supply (strong accumulation clusters).

- Green/Light colors: Areas with thinner supply.

Conclusion:

- The $97K–$100K range is currently a strong support zone, with a large accumulation cluster from investors.

- Above $100K, price levels like $101.33K and $102.8K could act as support or distribution zones as Bitcoin adjusts and consolidates at higher levels.

#COINMAP

—————

Related posts

Latest

Subscribe

Subscribe with your email to receive information and promotions from 8xTrading