The current trading situation of ETH in the market

🔍 ETH Leverage Positions (CME):

The CME chart shows a sharp increase in short positions on ETH futures contracts, currently reaching -5296 📉, a record high. This reflects a market sentiment strongly tilted toward a bearish outlook for Ethereum in the short term ⏬.

Leverage funds are now showing caution and betting on the possibility of a price decline for ETH 📊.

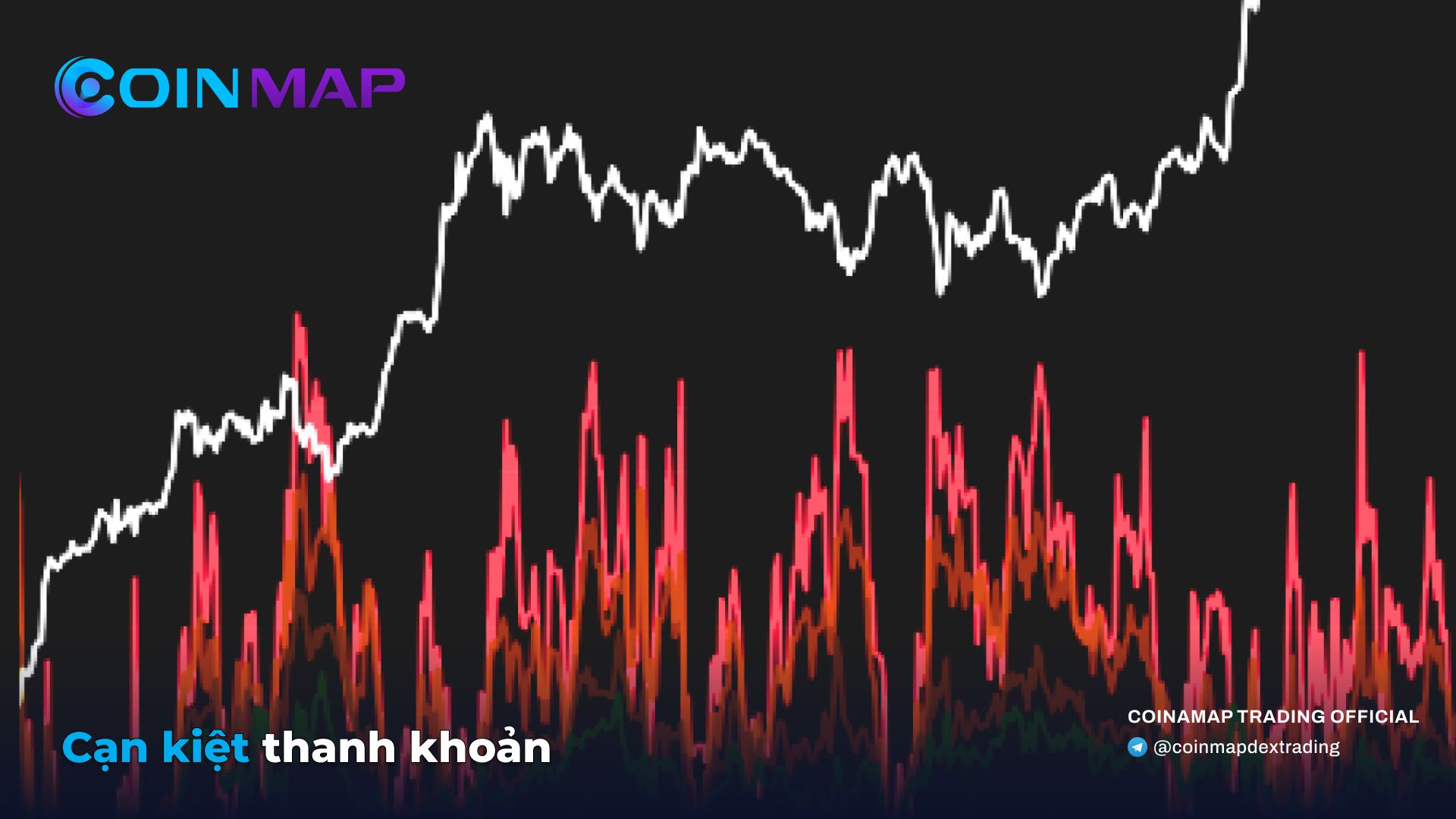

📈 Net Taker ETH on Exchanges (CryptoQuant):

Data from CryptoQuant indicates significant fluctuations in the Net Taker Volume of ETH 📊. Red points 🔴 represent large short positions from Binance and BitMEX, concentrated during periods of high volatility in ETH ⚠️.

ETH's price is currently approaching $4,000 💰, but the heavy short positions are creating substantial risk for a potential correction ⚠️.

🔑 Overall Conclusion:

The ETH market is being dominated by bearish sentiment from large funds and leveraged traders. The record-high increase in short positions while ETH approaches its peak price level calls for caution from retail investors ⚠️.

Investors should closely monitor upcoming market movements to make informed decisions 🧐. If the shorts are liquidated en masse, the market could experience a short squeeze, driving the price sharply higher 🚀.

#8xtrading

—————

Related posts

Latest

Subscribe

Subscribe with your email to receive information and promotions from 8xTrading